Could energy productivity cycles lead to credit opportunities

January 2024, From the Field

Key Insights

- We see signs that productivity in the energy sector is waning, which could lead to a bull market for commodities that is more secular in nature.

- Oil and gas bull markets are generally supportive of energy sector credits relative to the broader market, but there is typically performance differentiation among energy subsectors.

- We currently see opportunities in select oil field services issuers as well as independent exploration and production companies.

Written by

Steve Boothe, CFA®

Head of Investment‑Grade Fixed Income, Co-portfolio Manager, Corporate Income Fund

Steve Boothe, CFA®

Head of Investment‑Grade Fixed Income, Co-portfolio Manager, Corporate Income Fund

Elliot Shue, CFA®

Credit Analyst

Elliot Shue, CFA®

Credit Analyst

Unprecedented productivity gains associated with the U.S. shale revolution drove a nearly decade-long bear market in oil and natural gas prices. However, there are growing signs that the bear market could be subsiding. Such a transition to falling productivity would likely create a more supportive environment for energy investing.

Distinguishing features of commodities supercycles

Like stocks and bonds, commodities tend to trade in cycles. But commodities cycles differ from equity cycles in several ways. Prices of commodities, including oil, gas, metals, and even food, tend to move together as opposed to the more disparate equity market. Because of the substantial costs and lengthy timelines associated with commodities projects, bull and bear market cycles tend to be longer than equity market cycles, leading to the term “supercycles.”

What drives price changes in commodities markets?

Prices of commodities, including energy, fluctuate for a variety of reasons. Some short-term factors that can influence energy prices include geopolitics, weather conditions, and the health of the global economy. While these near-term factors can certainly result in notable changes in energy prices, our fundamental approach to investing focuses heavily on structural factors that can drive prices over the long term, such as changes in productivity.

The role of productivity

Rising productivity from technological innovations enables oil and gas companies to extract more of a commodity out of the ground at a lower cost, which puts downward pressure on the industry’s prevailing break-even costs and the commodity prices needed to incentivize operators to pursue new projects. As a result, increasing productivity becomes a bearish setup for commodities.

Over time, the gains in commodity output unlocked by these innovations diminish as companies maximize the benefits of the technology and underlying assets mature. New resources become harder to find or more expensive to develop, pushing up prevailing break-even costs. This transition to falling productivity has tended to be a bullish setup for commodities prices.

The recent productivity cycle

Oil productivity cycle

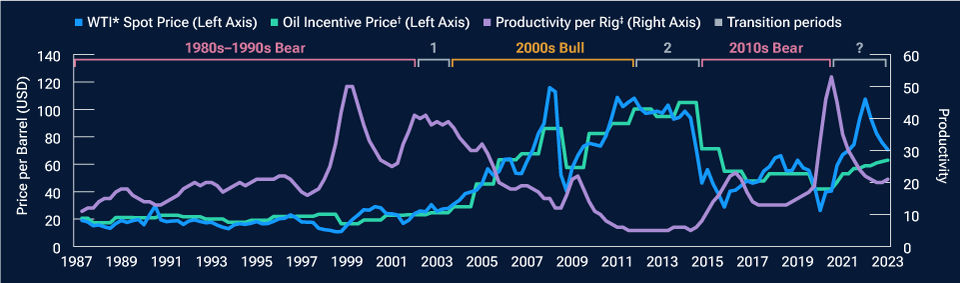

(Fig. 1) Changes in oil prices followed changes in productivity.

Past performance is not a reliable indicator of future performance.

Q3 1987–Q3 2023.

Sources: Bloomberg Finance L.P., Enverus, T. Rowe Price analysis.

*West Texas Intermediate (WTI)

†Oil Incentive Price is the marginal cost of new oil production, estimated by adding cost of goods sold, operating expenses, and sustaining capex.

‡Productivity per Rig is US oil production in barrels divided by Baker Hughes Oil Rig Count to estimate amount of oil per rig in operation.

The U.S. shale oil and gas revolution unleashed a surge in productivity and ushered in a bear market for oil and gas, but we see evidence that these productivity gains could be waning. There is typically a transition period when it is not yet clear which way the cycle could turn.

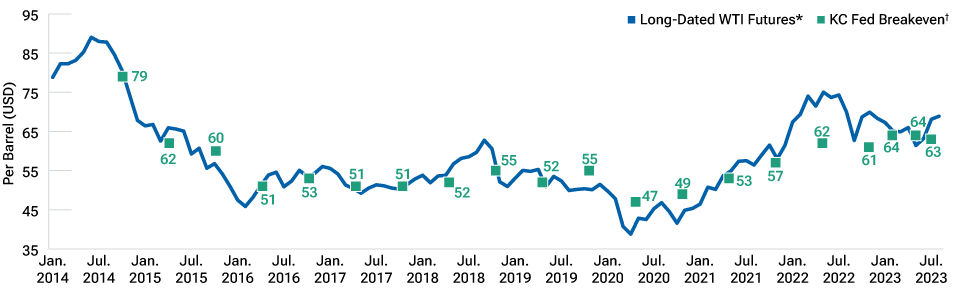

It is possible that as pandemic-related distortions normalize, what appeared to us as a structural change will end up being a cyclical dynamic. In that case, the market would return to reacceleration and productivity could pick up again, potentially putting downward pressure on oil prices. However, Figure 2 shows both market-based pricing (WTI futures) and producer surveys (Kansas City Federal Reserve (KC Fed) incentive price) exhibiting not only a recovery from pandemic distortions, but also an increase in the prices required to make a profit according to producers, which is likely driven by a slowdown in productivity in the U.S. as available oil and gas becomes more expensive to obtain. This dynamic leads us to believe that the commodities supercycle is turning.

Producer survey breakeven prices and market-based oil price expectations

(Fig. 2) Market-based pricing and producer survey indicate higher prices following recovery from pandemic.

Sources: Bloomberg Finance L.P., Federal Reserve Bank of Kansas City.

* WTI long-dated futures is represented by the three-year futures contract for WTI oil, a U.S. crude oil price assessment.

†The KC Fed asks energy firms in its district what oil price (WTI per barrel) was needed on average for drilling to be profitable.

See our equity colleagues’ research highlighting factors increasing costs to obtain oil and gas: “Why the Environment for Energy Investing Is Improving.”

Look for dispersion in a bull market

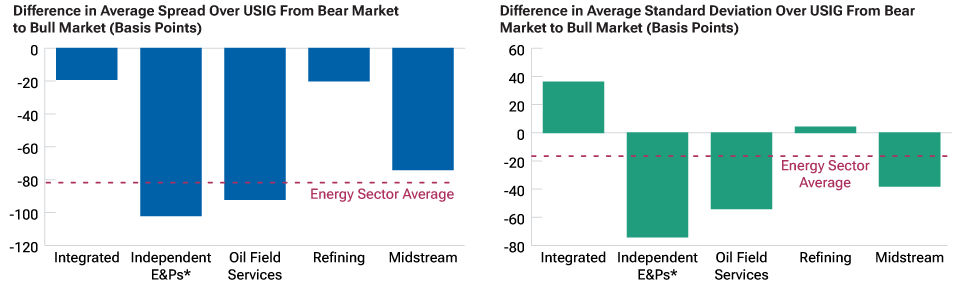

In this scenario, we see potential for energy credits to outperform the overall U.S. investment-grade bond market (USIG). Consider recent bull and bear market energy cycles: In the bear market, energy credits, on average, traded with wider credit spreads1 than the broad U.S. investment-grade corporate bond market. In the bull market, energy credit spreads were tighter, on average, than the broad investment-grade corporate market.2 The higher oil prices present during the bull market appeared to support energy sector assets, leading to outperformance compared with the broader market.

Bear market to bull market change in spread and standard deviation of spread between USIG and energy subsectors

(Fig. 3) Energy credit outperformance varied by subsector during energy bull market.

Past performance is not a reliable indicator of future performance.

As of September 30, 2023.

Sources: Bloomberg Corporate Index; T. Rowe Price analysis.

*Independent exploration and production

Energy subsector classifications as determined by the Bloomberg Industry Classification System. Average spread is the average of monthly spread over the stated periods: Bear market (9/30/2014–12/31/2020) and bull market (6/30/2003–6/30/2012) troughs in oil prices (the quarter in which the trough occurred) represent the beginning of bull markets, while peaks (the quarter in which the peak occurred) represent the end of the bull and beginning of bear markets.

Standard deviation measures historical volatility. It is a measure of the amount of variation or dispersion of a set of values. A low standard deviation indicates that the values tend to be close to the mean of the set, while a high standard deviation indicates that the values are spread out over a wider range, implying greater volatility. A basis point is 0.01 percentage point.

Energy credits also displayed reduced volatility during the recent energy bull market. During this period, yield changes in energy sector credits were less pronounced when compared to the broader U.S. investment-grade market.

Figure 3 illustrates that, while the broader energy market outperformed and was less volatile during the most recent bull market, energy subsectors participated to different degrees. The independent E&P and oil field services subsectors displayed the greatest performance differences in the recent bull and bear markets, which makes intuitive sense—they are the most sensitive to oil prices. We believe that the impact of a productivity cycle transition on sectors further down the value chain would be mixed.

Where do we see opportunities?

The setup for a bullish cycle is evident, prompting us to consider adding to positions featuring favorable fundamentals and relative value. Should the global economic environment become recessionary, pushing oil prices lower in the short term, we could add exposure to companies where we see improved relative value. The magnitude of differences between bull and bear markets is notable and highlights the importance of identifying a change in the energy cycle.

Where we see opportunities in energy subsectors

Oil Field Services

Provide services and equipment to oil and gas producers and are likely to be the biggest winners early in the cycle. As productivity falls, their products and technologies will become critical to producers maintaining production. Amid higher prices and activity, they should benefit from increased demand.

Independent E&Ps

Primarily produce oil and gas from their properties and are likely to be the most direct beneficiaries of higher commodity prices. This subsector could also increase capital spending, potentially eroding credit quality.

Midstream

Owns assets that process hydrocarbons from the wellhead and transport them further downstream; also has some upside, although the benefit from higher commodity prices is far lower than for E&Ps.

Integrated Energy Companies

These global oil and gas companies are vertically integrated. They benefit directly from higher commodity prices, but a portion of that gain is diluted because of their exposure to downstream businesses, such as refining and petrochemicals.

Refiners

Refine crude oil into gasoline and other products. They appear less compelling at the sector level, in our view. Higher oil and gas prices translate to higher input costs, resulting in reduced margins.

Why the environment for energy investing is improving

Downshift in U.S. shale productivity should lift oil and gas prices over the long term.

1Credit spreads measure the additional yield that investors demand for holding a bond with credit risk over a similar‑maturity, high‑quality government security.

2T. Rowe Price analysis used the Bloomberg U.S. Corporate Investment Grade Bond Index to represent the broad U.S. investment-grade bond market. The energy sector as well as energy subsectors were classified as determined by the Bloomberg Industry Classification System.

Additional Disclosure

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Important Information

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of January 2024 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates or forward-looking statements provided.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. Commodities are subject to increased risks such as higher price volatility, geopolitical and other risks. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price, Inc.

ID0006576 (01/2024)

202401-3335693